How to write an ESG report

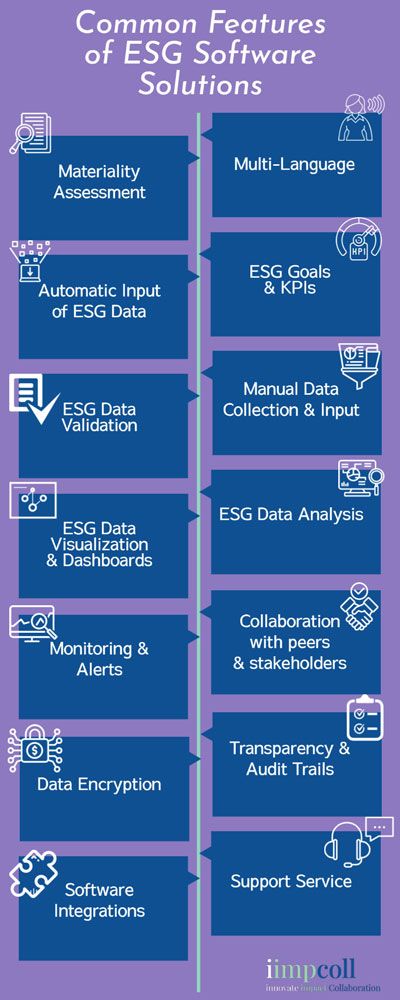

Writing an ESG report is an excellent way for European businesses to demonstrate their commitment to environmental, social, and governance (ESG) issues. Effective ESG disclosure is crucial for companies to provide external stakeholders, such as asset managers, authorities, and potential customers, with a comprehensive understanding of the risks pertaining to their operations, emissions, and supply chain. This level of transparency allows for informed decision-making and fosters trust and confidence in company management.

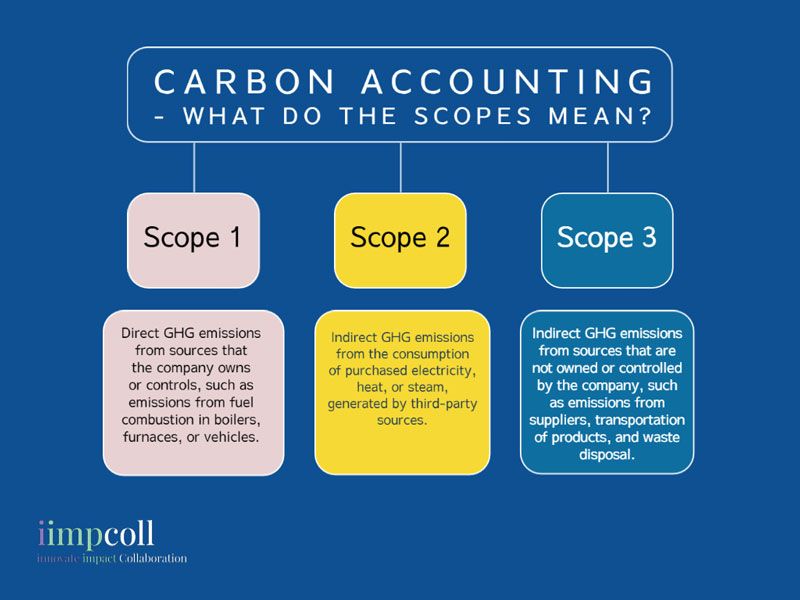

An ESG report provides investors with crucial information about the company's current activities and future plans in these areas. It also helps companies measure their performance on issues such as carbon emissions, human rights, corporate governance structures, and board diversity.

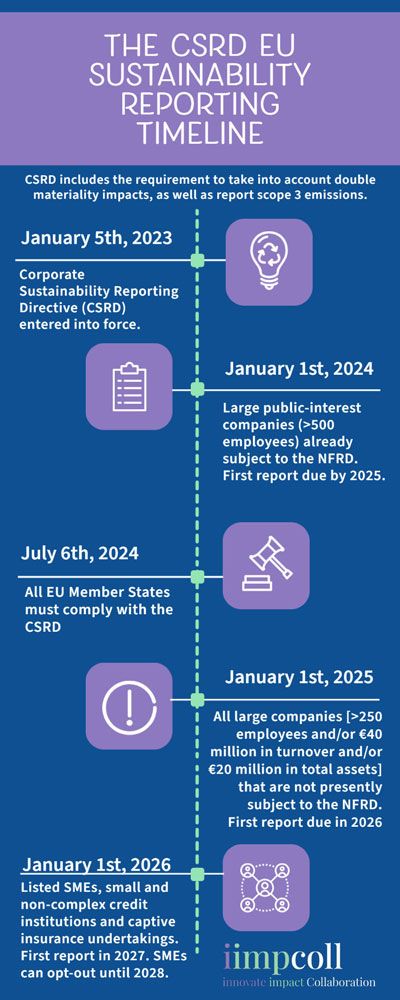

ESG reporting is currently a legal requirement (CSRD) for many European entities and will encompass all European companies and organizations by 2027/28.

Be aware that the steps outlined in this article are general steps. If you are interested in digging into the finer details of each step, enjoy further reading here on the site, or contact us directly. We are here to help!